Google And Goldman Back Bitcoin Startup For Small Businesses

Marwan Forzely has come a long way since

his days at Western Union. The serial entrepreneur, who sold his

previous company to Western Union to help the money-transfer giant

directly connect to customer bank accounts, has raised $25 million to

cut intermediary banks out of the payment process altogether.

Instead

of relying on a series of correspondents to move money between

different jurisdictions around the world, Marwan’s latest venture, Veem,

uses bitcoin to directly connect its clients’ bank accounts with

suppliers and customers.

While neither counterparty is required to

directly hold bitcoin, and an algorithm automatically routes

transactions along the most efficient payment rails, more than half the

transactions processed by Veem rely on the cryptocurrency as a

replacement for correspondents.

Led

by banking giant Goldman Sachs, with GV (formally Google Ventures),

Kleiner Perkins, Silicon Valley Bank, Trend Forward Capital, and Pantera

Capital also participating, the investment in enterprise-payments

startup Veem is primarily a move to accelerate the firm’s exponential

growth.

Central to the investors’ interest in Veem is the built-in

stickiness of the model, which has proved to be adept at turning

recipients of Veem payments into Veem users. Since the San

Francisco-based company raised its first round of venture capital in May

2015, it has grown from a mere 590 customers to more than 80,000 today.

As the price of bitcoin hovers around $6,500, compared with $300

when Veem raised its first round, the company is helping blaze the

trail for next-generation bitcoin startups that give customers access to

bitcoin’s speed and traceability without their even knowing it.

“What’s

important about this round is the acknowledgement of the size of the

opportunity, the size of the market, the size of the pain point that

we’re solving for,” said Forzley. “And it’s an endorsement of the growth

that we’re experiencing.”

This latest strategic investment

follows on a $24 million Series B raised in March 2017 and brings the

total amount raised to $69.3 million. Lead investor Goldman Sachs made

the strategic investment via its Principal Strategic Investment Group,

which has been increasingly active

in the blockchain space. As part of the investment, Goldman Sachs

managing director Rana Yared will join Veem as a nonvoting board

observer.

While Veem is not disclosing the terms of the investment

or the valuation, Marwan says revenue has grown four times since the

same time last year. Nondisclosure agreements prevent Veem from sharing a

specific breakdown of the revenue sources, but according to Marwan a

significant percentage of the company’s revenue comes from integration

with online accounting services like Quickbooks, Xero and Netsuite.

To

maintain the exponential growth that has seen the company increase its

customer base by 13,000% over the past three years, Veem has opted to

focus spending from this latest round on building out new partner

integrations. Meanwhile, the onboarding process itself will rely on

increased automation, including built-in anti-money-laundering and

know-your-customer compliance.

Increasingly, Goldman Sachs’

Principal Strategic Investment Group is strategically backing blockchain

companies that have the potential to improve service for the bank’s

clients, including enterprise software developer Digital Asset Holdings,

payments startup Circle and infrastructure provider Axoni. But fellow

Veem investor GV—with Google parent company Alphabet as the sole limited

partner—has a much more profit-driven motive. With investments

including commodities trader LedgerX and central bank alternative Basis,

GV general partner Karim Faris believes Veem could be the first bitcoin

startup to go public.

“We’re not a strategic investor,” said

Faris, who also sits on Veem’s board of directors. “It’s definitely not a

strategic thing. It’s an opportunity to create a stand-alone company

and in the process make a financial return on a good exit or an IPO down

the line.”

While Forzley has so far remained quiet about the

possibility of going public, this wouldn’t be his first time with an

exit for a payments startup. Shortly after obtaining a bachelor's degree

in computer science from the University of Ottawa, Forzley developed an

interest in financial payments, eventually founding early online

payments startup eBillme.

In October 2011 Western Union bought

eBillme for an undisclosed amount and Forzely joined as general manager

in charge of strategic partnerships, helping to integrate his technology

into Western Union for what would eventually be called WuPay. The

reason for his career-long interest in payments is simple:

“Whatever

you do in life, at the end of the day there’s a payment,” said Forzley.

“Payment technology is at the core of what people do and their

livelihood.” If that early experiment with payments focused on making

debit cards unnecessary, Veem is significantly more ambitious in

targeting the massive correspondent banking industry.

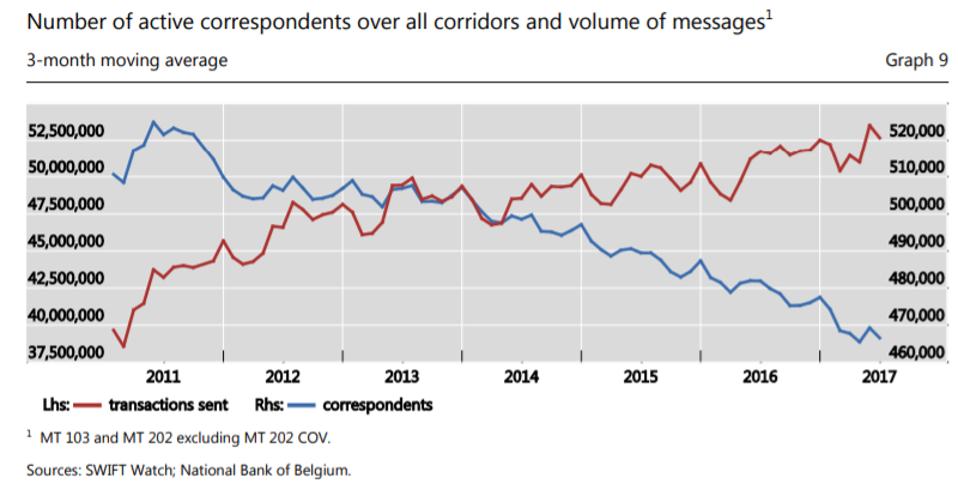

To give an idea of how big the industry really is, a 2017 report from

the Financial Stability Board that looks at the resilience of financial

infrastructures found that there were 470,000 correspondents using the

Swift bank messaging platform alone. Since 2011 however, that number has

dropped by 8%, perhaps as a result correspondent mergers, lost licenses

or the movement of business to Swift competitors, according to the

report.

This

graphic from a 2017 Financial Stability Board report shows that even as

the total number of correspondents decreases on the Swift platform, the

total transaction volume is getting higher.FSB

Ironically

though, even as correspondent banks face increasing competition, Swift

has seen an increase in total transactions, according to the same

report. Vying for that ever growing market are startups like

Nairobi-based BitPesa and

Veem, which seek to cut out those middlemen by replacing them with a

mix of faster, more transparent bitcoin and other alternatives.

“When

you reconfigure the way money moves, when you use it with a different

infrastructure, you simplify the cost structure and you turn money back

to the business owner, the end user,” said Forzley.

See more at: Morisberacha.com

Comentarios

Publicar un comentario