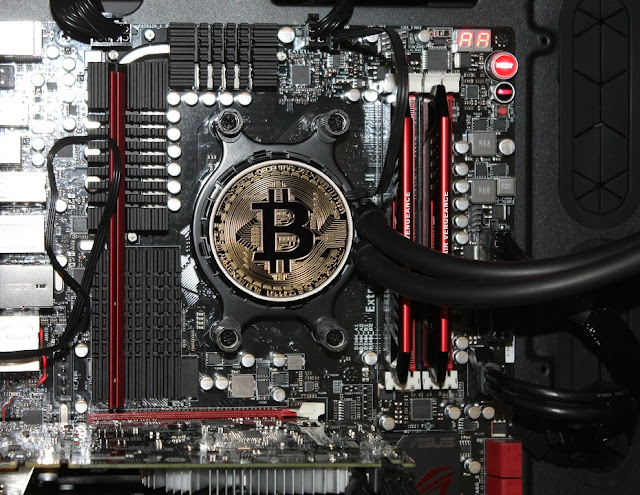

This company thinks it can help solve Bitcoin’s energy problem

Soluna says its new business model can be good for blockchains and clean energy development. By Mike Orcutt It’s undeniable: Bitcoin’s energy guzzling is a growing environmental problem. It’s been estimated that the network uses nearly as much electricity as all of Ireland, raising alarms about its carbon footprint. In theory, though, it doesn’t have to consume nearly as much fossil-fuel-based power as it does today—and a new renewable-energy company has an ambitious plan to prove it. The firm, called Soluna , has acquired a 37,000-acre wind-farm site in Morocco that it says has the potential to host up to 900 megawatts of power-generating capacity. (A recent estimate (PDF) suggests that the Bitcoin network uses at least 2.55 gigawatts.) Development of the site began nine years ago, but progress stalled under its previous owners. Soluna, which has teamed with the German wind-power developer ALTUS AG , aims to build at least 36 megawatts of capacity by